Table of Contents

Small businesses face many challenges during their growth period, financial challenges being the top on the list. Under such circumstances, contacting a bank for loans and credits can be time-consuming. That’s why the concept of peer-to-peer lending has taken a stronghold. These leading peer-to-peer lending platforms eliminate the need for middlemen and connect you directly with lenders. In this article, we’ll review top peer-to-peer lending providers that are exceptional in their service delivery!

An Introduction to Peer-to-Peer Lending

The peer-to-peer lending method has taken a momentous speed in recent years owing to its effectiveness in helping small businesses through their financial crunches. This model brings the private investors directly to their peers needing loans on one platform. Moreover, it also eradicates the need for middlemen, such as banks or credit unions, strengthening the ties between the lender and the borrower.

Peer-to-peer lending is a win-win for both the borrower and the investor. Firstly, it eliminates the need for a lengthy application process and certain credit limits. Through this crucial advantage, the borrower gets more time and head space to focus on other crucial aspects of the business. Secondly, the lender also gets higher returns on their investment through P2P lending than any other type of investment.

Top Peer-to-Peer Lending Platforms

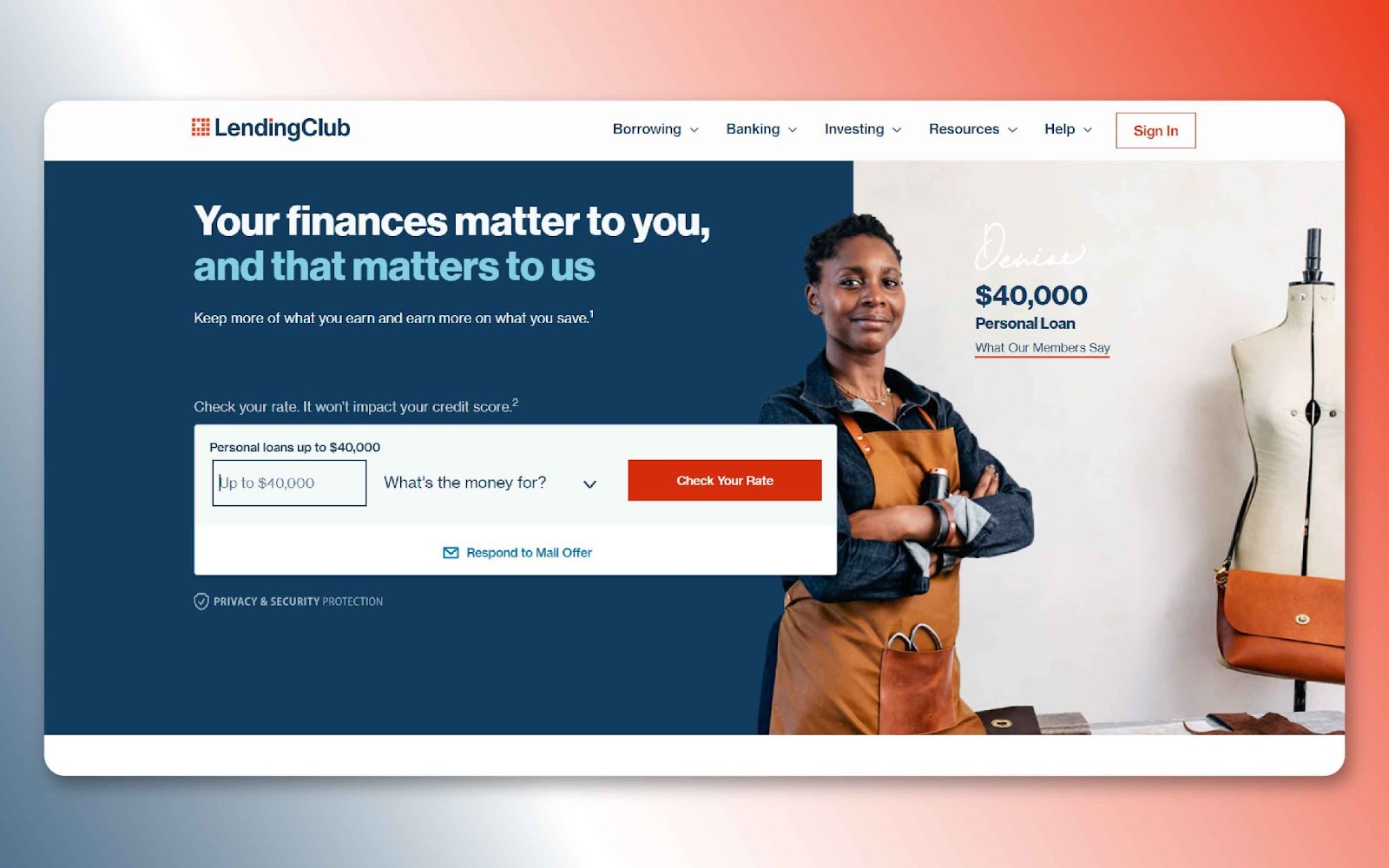

LendingClub

LendingClub was launched in 2007 in the United States of America as one of the oldest peer-to-peer lending marketplaces. It has expanded to become one of the biggest and most reliable companies, providing several loan services to satisfy every need.

LendingClub offers personal loans, auto refinance, and small business loans, thus serving all citizens. It seeks to lessen credit availability and cost by using an online marketplace that brings buyers and sellers of credit directly. By having an easy-to-fill online application and relatively low interest rates. LendingClub works with millions of borrowers to fulfill their financial potential and assist investors in gaining healthy profits.

Key Features:

- Personal loans up to $40,000.

- Business loans up to $500,000.

- Fixed interest rates and no prepayment penalties.

- Simple online application process.

- Access to a large network of individual and institutional investors.

Specifications:

- Minimum credit score: Typically 600+.

- Loan terms: 3 to 5 years for personal loans and 1 to 5 years for business loans.

- Funding time: Usually within a few days after approval.

- APR range: Approximately 6.95% to 35.89%.

Platform Fee/Commission:

- Origination fee: 1% to 6% of the loan amount.

- Late payment fee: Greater than $15 or 5% of the unpaid installment.

Visit LendingClub.

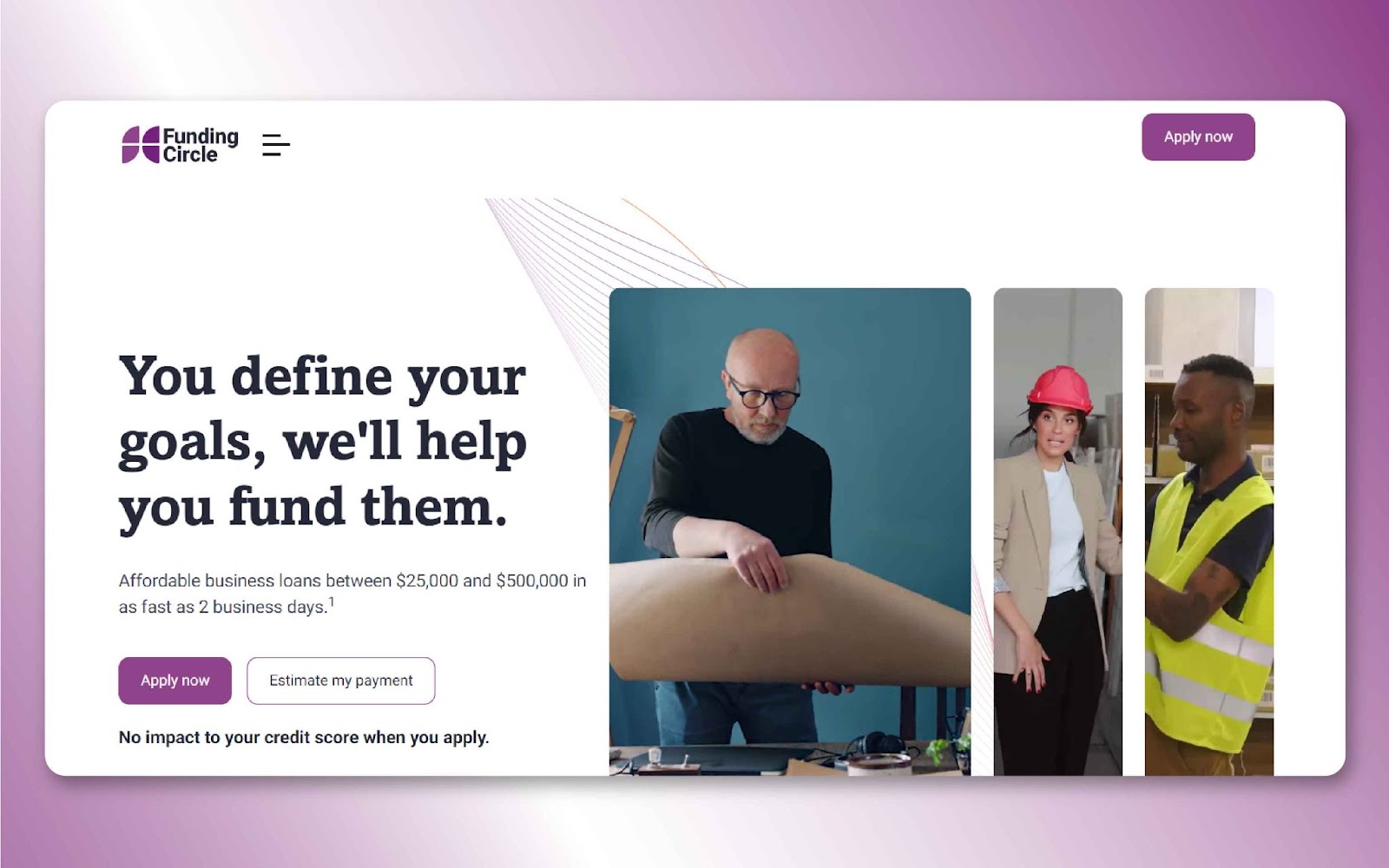

Funding Circle

Funding Circle was launched in the United Kingdom in 2010 and entered the United States market in 2013. It is currently one of the largest P2P lending marketplaces for small businesses. Thus, it helps unite small business owners who need financing and investors eager to earn stable revenues.

Funding Circle is well recognized for its transparency, fairly charged and reasonable interest rates, and highly committed customer care services. It deals with financing that best suits the growth and development of micro-enterprises by giving loans for the expansion needs of business persons, with custom-made loan sizes and loan periods.

Key Features:

- Business loans from $25,000 to $500,000.

- Competitive fixed interest rates.

- Dedicated account managers for personalized service.

- Simple online application with quick decisions.

- Loans are designed to support growth and expansion.

Specifications:

- Minimum credit score: Typically 620+.

- Loan terms: 6 months to 5 years.

- Funding time: As fast as five days after approval.

- APR range: Approximately 4.99% to 27.79%.

Platform Fee/Commission:

- Origination fee: 3.49% to 6.99% of the loan amount.

- Late payment fee: 5% of the unpaid installment.

Visit Funding Circle.

Also Read: 7 Best Online Lenders for Small Businesses

Kiva

Kiva is a non-profit, peer-to-peer microlending program founded in 2005 to address poverty through microfinance. Among other features that distinguish Kiva from other lending sites, Kiva enables individuals to lend as little as $25 to people and businesses around the globe.

Regarding operations, Kiva is outstanding as its model focuses more on the social aspect to allow lenders to provide loans without interest to the borrowers to support their projects. It has a presence in all the world’s major markets and is dominant in the US; it is a social underwriting platform, which means that the borrower’s social circle vouches for him and his creditworthiness.

Key Features:

- Interest-free loans for borrowers.

- Crowdfunded microloans from a global community of lenders.

- Loans up to $15,000.

- Emphasis on social impact and community support.

- No credit score requirement based on social underwriting.

Specifications:

- Minimum credit score: Not required.

- Loan terms: Typically 6 to 36 months.

- Funding time: Varies based on crowdfunding speed.

- APR range: 0% for borrowers; lenders do not earn interest.

Platform Fee/Commission:

- No origination fee for borrowers.

- Optional donation from lenders to support Kiva’s operations.

Visit Kiva.

Also Read: Securing Your Finances: 6 Best Banks in America

Upstart

Upstart is a Fintech, an online personal lending marketplace started in 2012 by ex-Google employees. The platform distinguishes itself from its peers because Marlette gathers data and analyzes it using artificial intelligence and machine learning to determine borrowers’ creditworthiness. Such an approach provides Upstart with a way of availing credit, especially personal loans, to individuals who may not necessarily have a credit history but are highly creditworthy.

The objective and purpose of Upstart can be stated as the provision of affordable credit and the aim of limiting risks for investors. The option of applying for credit with a fast approval decision is beneficial to borrowers who require a quick credit facility for different purposes, including, but not limited to, consolidating debts, remodeling a house, or any other emergencies.

Key Features:

- Personal loans from $1,000 to $50,000.

- AI-driven approval process.

- Quick online application with instant approval decisions.

- Fixed interest rates with no prepayment penalties.

- Loans for various purposes, including debt consolidation and personal expenses.

Specifications:

- Minimum credit score: Typically 620+.

- Loan terms: 3 or 5 years.

- Funding time: As fast as 1 business day after approval.

- APR range: Approximately 5.31% to 35.99%.

Platform Fee/Commission:

- Origination fee: 0% to 8% of the loan amount.

- Late payment fee: Greater than $15 or 5% of the unpaid installment.

Visit Upstart.

Prosper

Prosper is one of the pioneers of the US-based peer-to-peer lending platforms. It was founded in 2005 and has gained much popularity. This target provides consumers with personal loans for debt consolidation, home renovations, medical bills, and other obligations. Prosper operates as a P2P marketplace that allows borrowers to get funds from individual and institutional investors.

This is specifically due to the beating fixed interest rates offered on the platform, a clear process, and a general focus on borrowers’ best interests. Thus, staying ahead in such points makes Prosper a firm candidate for lending to reliable borrowers with adequate experience and possessing sound IT infrastructure that guarantees investors reliable returns.

Key Features:

- Personal loans from $2,000 to $40,000.

- Competitive fixed interest rates.

- Simple online application process.

- No prepayment penalties.

- Access to a large network of investors.

Specifications:

- Minimum credit score: Typically 640+.

- Loan terms: 3 or 5 years.

- Funding time: As fast as 1 to 3 business days after approval.

- APR range: Approximately 7.95% to 35.99%.

Platform Fee/Commission:

- Origination fee: 2.41% to 5% of the loan amount.

- Late payment fee: Greater than $15 or 5% of the unpaid installment.

Visit Prosper.

Peerform

Launched in 2010, Peerform is a USA-headquartered P2P lending marketplace that provides personal loans to individuals with different credit standings. Thus, the platform was launched by a group of trading experts who were against traditional banking. Current loan applicants are evaluated for creditworthiness using a loan analyzer exclusively developed by Peerform to reach many customers with cheap loans.

The provided online application guarantees applicants’ approval within a short period. It enables different people to secure loans for any contingent, including debt clearance, home renovation expenses, or any other relevant cause. Due to its focus on its clients and how it operates, Peerform has become quite popular among borrowers with flexible funding needs.

Key Features:

- Personal loans from $4,000 to $25,000.

- Competitive fixed interest rates.

- Quick and simple online application.

- No prepayment penalties.

- Loans for various purposes, including debt consolidation and home improvement.

Specifications:

- Minimum credit score: Typically 600+.

- Loan terms: 3 or 5 years.

- Funding time: Usually within a few days after approval.

- APR range: Approximately 5.99% to 29.99%.

Platform Fee/Commission:

- Origination fee: 1% to 5% of the loan amount.

- Late payment fee: Greater than $15 or 5% of the unpaid installment.

Visit Peerform.

Conclusion

In sum, the peer-to-peer lending platforms facilitate new opportunities for borrowers and investors by changing the oriental model of the financial industry. Starting from the various types of loans that LendingClub offers and Kiva’s various international microfinancing possibilities, every website holds certain opportunities. From growing a small business to attaining personal financial solutions, each platform provides the user with the tools in the form of capital and investment opportunities that reflect the user’s objectives and beliefs.

FAQs

Are peer-to-peer lending platforms safe?

Indeed, now safe and globally accepted tools such as LendingClub and Funding Circle maintain decent security of the user’s financial data and follow the rules and regulations of the countries where they operate.

How do peer-to-peer lending platforms make money?

Scripts usually generate revenue through origination fees collected from borrowers and servicing fees from managing loans sold to investors.

What happens if a borrower defaults on a peer-to-peer loan?

If a borrower fails to repay, the platform starts to recover the amount. Investors may get proportional recovery depending on the recovery methods and contracts of the loan products.